Multifamily real estate is one of the best ways — if not the best — for investors to hedge against inflation

Economists and other commentators have offered some colorful metaphors for inflation over the years.

Ronald Reagan famously warned that it’s “as violent as a mugger, as frightening as an armed robber, and as deadly as a hitman.”

Milton Friedman called it “taxation without legislation.”

Perhaps the best take comes from writer and humorist Sam Ewing:

“Inflation is when you pay fifteen dollars for the ten-dollar haircut you used to get for five dollars when you had hair.

Based on the above we might ask, “How can you combat this violent mugger looking to tax you into premature baldness?” But inflation is no laughing matter for investors. It really can decimate your returns.

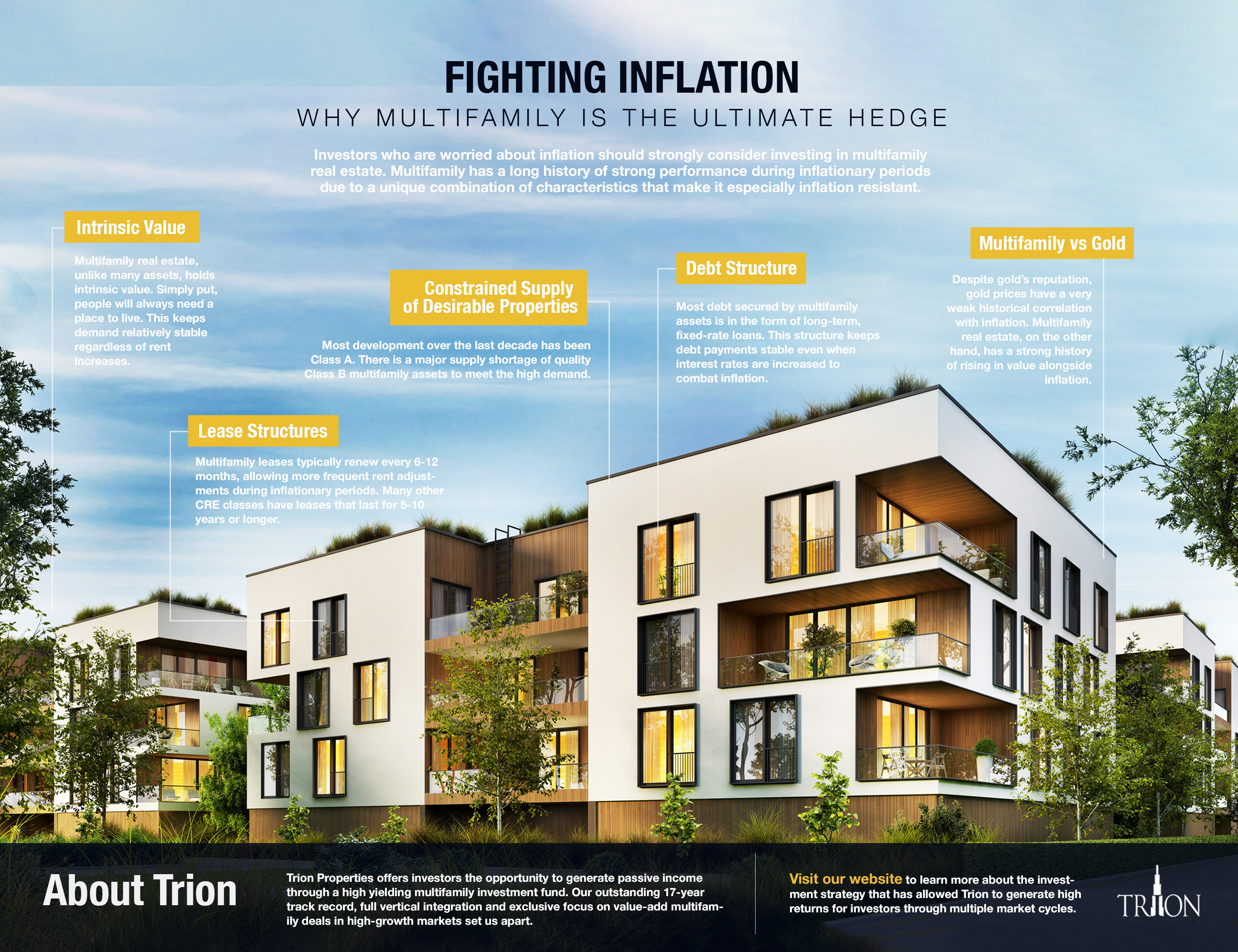

At Trion, we feel strongly that multifamily real estate is one of the best ways — if not the best — for investors to hedge against inflation.

Our latest infographic briefly explains the unique features that historically make multifamily such a strong performer in periods of inflation. Read and see how multifamily can help you protect your portfolio.